To access, please certify that you are (or that you advise) someone that is:

CLOs: COLLATERALIZED LOAN OBLIGATION

CLO Private Credit Funds: The $1 Trillion Dollar Asset Class

Collateralized Loan Obligations (CLOs) are a high-yield, floating-rate income alternative, with a long history of competitive returns and resilience.1 The CLO asset class offers a variety of benefits and investor-friendly features but they're not widely understood. Investors and advisors globally are seeking to learn more about this asset class.

1. Goldman Sachs

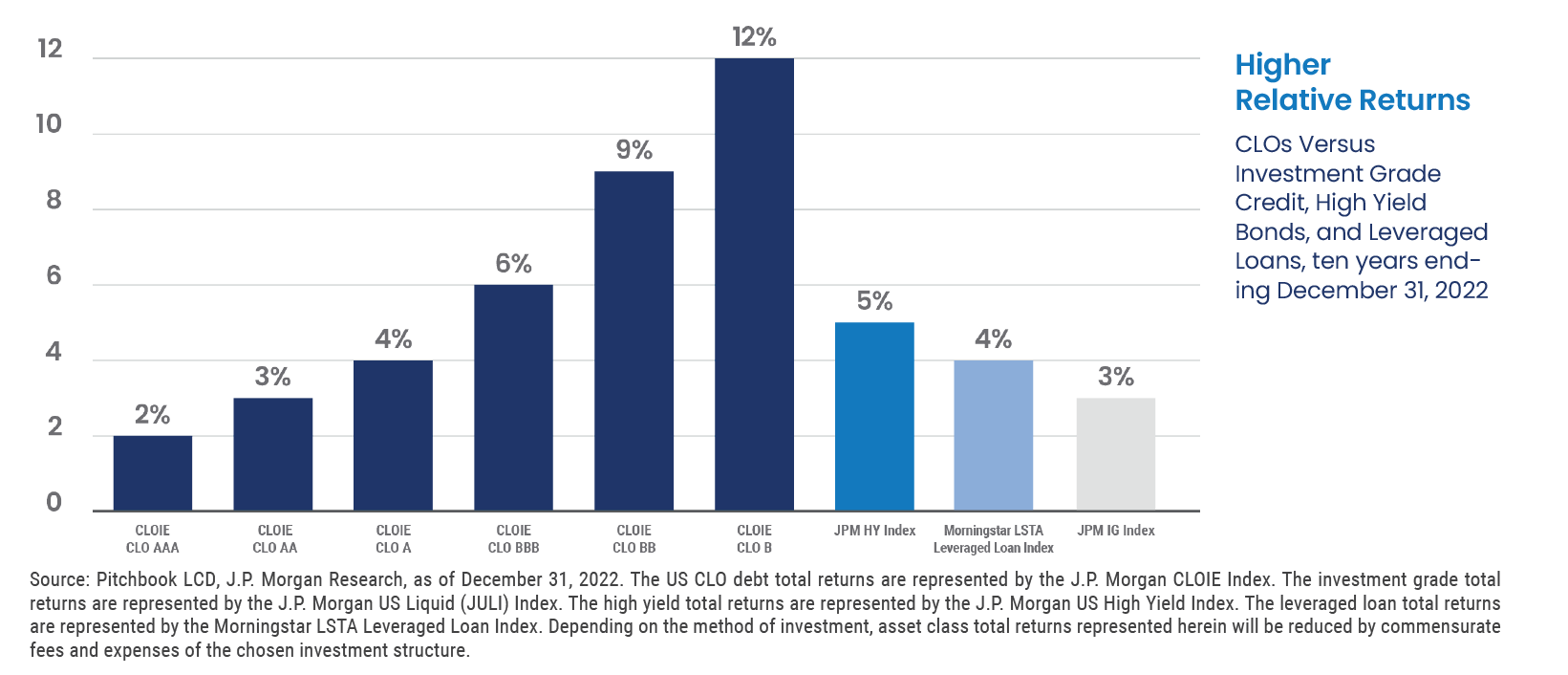

High Yield & Current Income

CLOs have offered historically strong returns, higher yields, and relative value compared to securities with similar ratings2

2. Goldman Sachs

Resilience & Risk Mitigation

According to S&P Global, “CLOs have shown resilient performance through multiple economic downturns.” Of the nearly 21,000 CLO tranches rated by S&P, only 67 or 0.3% have defaulted.3

3. S&P Global

Investor-Focused Structure

CLOs are actively managed, diversified pools of hundreds of senior secured, high-yield, sub-investment-grade corporate loans. The CLO structure is known for its transparency and the guardrails put in place for downside risk protection.

Diverse & Global Investor Community

The CLO investor community is global and diverse. Conservative investors may prefer AAA or AA CLO tranches. Investors pursuing higher yields (and risk) may focus on CLO mezzanine or equity tranches.

Ready to speak with our team?

Approved on leading insurance carriers

Historically strong returns vs. Corporate fixed income

Increase in AUM raised in 1 year

Wealth Management Firm

Increase in new AUM raised in 1 year

Commercial Real Estate Fund Sponsor

Increase in monthly website visitors

Turnkey Asset Management Platform

Return on LinkedIn ad spend (ROAS)

Real Estate Investment Sponsor

CLO fast facts for the tax-aware investor

Sources: LCD, S&P Global, Pinebridge, Guggenheim, SIFMA, JPMorgan, Bloomberg

$1T

Asset Class

20,997

Tranches Rated by S&P 1996-2021

0.3%

Default Rate

64%

AAA Share of Global CLO Market

24%

AA to BBB Share of Global CLO Market

12%

Mezzanine & Equity Share of Global CLO Market

-0.24

Correlation to US Treasury Bonds

0.11

Correlation to Aggregate Bond Index

Could private credit funds be the solution

for income seekers? CLO FAQs

What are CLOs and how are they managed?

CLOs (Collateralized Loan Obligations) are actively managed, diversified pools of senior-secured loans primarily to large U.S. corporations. Underlying CLO pools typically contain hundreds of floating rate, high yield, below investment grade loans. Active management is important for CLO managers, who are empowered to navigate changes in credit markets and individual companies.

What are CLO “tranches”?

Securities issued by CLO pools are available in a variety of tranches. Each tranche offers a risk/return profile based on its seniority and its order in the claims on the interest and principal payments from the underlying pool of loans. CLO tranches range from investment grade (AAA - A) to mezzanine, which include senior and junior mezzanine that are primarily non-investment grade (BBB - B). CLO equity receives the residual interest available after payments to other tranches. Investors can select the type of CLO that fits their objectives.

Who invests in CLOs?

CLO investors represent a diverse, global community. CLOs benefit from high daily trading volumes, liquidity, and an expanding investor base. The global CLO investor community encompasses banks, insurance companies, pension funds, hedge funds, and asset managers, as well as mutual funds and ETFs.

What are the risks of CLOs?

While CLOs offer many benefits, investors must understand the risks. Credit risks include problems with underlying borrowers and potential losses from default. Market risks include illiquidity during periods of distress. People risk refers to the wide dispersion of performance among CLO pool managers. Reinvestment risk results when underlying loans are prepaid, potentially interrupting cash flows. These are just a few of the risks CLO investors should know.

OVERVIEW OF CLOs

Not ready for a call just yet?

Not a problem — we invite you to download our comprehensive guide to CLO investing:

13 Powerful Benefits of CLOs for Today’s Income Seeking Investor (and 7 Risks to Know)

Our guide provides an in-depth overview of the structure, performance, and risks of CLOs for yield-seeking investors.

Please note that Clarion Capital does not provide legal, tax, or accounting advice.

/DRAFT%20-%2016585%20CP%20Beauty%20Shots%201080x1080%20v2@2x.png)